How To Read Mortgage Rate Sheet

Contents

But now the balance sheet is being allowed to run off, up to $50 billion per month. As the Fed slows and ultimately ends quantitative easing, investors could see the potential for lower dollar prices.

Meanwhile, the two largest ice sheets on Earth – the Greenland ice sheet and the Antarctic ice sheet – are losing mass at an.

Low fixed rate & adjustable rate mortgage home loans. See rate sheet for details. couple in their new home bought with sdccu fixed rate mortgage loan.

By looking at a rate sheet (online or printed on paper), you can choose a loan with more information. You will want to have an idea of what program and term you are interested in. Programs are the type of loans – conventional, FHA, etc. Term refers to the number of years (typically 15 or 30) on the mortgage.

Interest Only Mortgage Rate Calculator Calculator Rates Interest-only Calculator Interest Only loan payment calculator. This calculator will compute an interest-only loan’s accumulated interest at various durations throughout the year. These amounts reflect the amount which would need to be paid in order to maintain a constant principal balance.

BECU mortgage rates 10/02/2019 products Interest Rate discount points apr estimated Payment No. of Payments Example Loan Amount Owner Occupied?

Construction Loan Interest Rates Today 25 Year Refinance Rates July 4,2019 – Compare Washington 20-Year Fixed refinance mortgage refinance rates with a loan amount of $250000. To change the mortgage product or the loan amount, use the search box on the right. Click the lender name to view more information. mortgage rates are updated daily.Construction-to-permanent loans. The lender converts the construction loan into a permanent mortgage after the contractor finishes building the home. The permanent mortgage is like any other mortgage. You can choose a fixed-rate or an adjustable-rate loan and specify the loan’s term, typically 15 or 30 years.

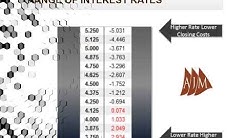

How to Read a Mortgage Rate Sheet Rates and YSPs. Most rate sheets contain a listing of note rates and a table. Lock Periods. Loan pricing is typically dependent on the lock period. Adjustments. The rates on the top of a rate sheet are generic. No Closing Cost Loans. The yield spread premium.

Locally owned Portland Oregon Mortgage Broker with outstanding reviews and service.. Read Our Reviews. the same margin, making comparison relevant and transparent under one pricing engine holding all preferred lender rate sheets .

· Today I’ll be (hopefully) demystifying how to read a balance sheet, a potentially confusing beast for those unfamiliar with it. First off, what is a balance sheet and what does a balance sheet show? At it’s simplest, a balance sheet shows what assets.

At the time of the central bank’s first increase, the interest rate on a 30-year fixed-rate mortgage was around 6.3 percent. She came to The Washington Post in 1996 from the Los Angeles Daily News.

To Rate Read Sheet How Mortgage – Capoeiranagomiami – The SmartAsset Guide to mortgage rate sheets – Mortgage rate sheets can look intimidating and ominous, not only to consumers, but to mortgage professionals as well. In today’s market, mortgage rates not only change daily, but are based on many factors specific to the individual. 15.

To Rate Read Sheet How Mortgage – Capoeiranagomiami – The SmartAsset Guide to mortgage rate sheets – Mortgage rate sheets can look intimidating and ominous, not only to consumers, but to mortgage professionals as well. In today’s market, mortgage rates not only change daily, but are based on many factors specific to the individual. 15.